| Previous Next Index Image Index Year Selection | |

|

|

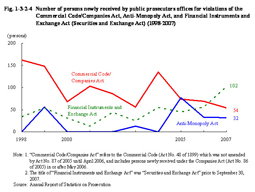

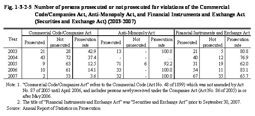

2 Economic offenses Fig. 1-3-2-4 Number of persons newly received by public prosecutors offices for violations of the Commercial Code/Companies Act, Anti-Monopoly Act, and Financial Instruments and Exchange Act (Securities and Exchange Act) (1998–2007) In FY2007, the Securities and Exchange Surveillance Commission filed formal accusations for 12 cases (33 persons including juridical persons) with public prosecutors for Financial Instruments and Exchange Act (Securities and Exchange Act) violations. More specifically, four cases (11 persons) were charged with insider trading, six cases (16 persons) with market manipulation, and two cases (six persons) with spreading of rumors and fraudulent means (Source: The Securities and Exchange Surveillance Commission).In FY2007, the Fair Trade Commission filed an accusation on one case (11 persons including juridical persons) for Anti-Monopoly Act violations. Table 1-3-2-5 shows the number of persons prosecuted or not prosecuted by public prosecutors offices over the last five years for violations of the Commercial Code and Companies Act, Anti-Monopoly Act, and Financial Instruments and Exchange Act (Securities and Exchange Act). Fig. 1-3-2-5 Number of persons prosecuted or not prosecuted for violations of the Commercial Code/Companies Act, Anti-Monopoly Act, and Financial Instruments and Exchange Act (Securities and Exchange Act) (2003–2007) In 2007, summary trial procedures were taken for one out of two persons prosecuted for violations of the Commercial Code/Companies Act, and for eight out of 67 persons prosecuted for violations of Financial Instruments and Exchange Act (Securities and Exchange Act), but all other prosecuted persons were indicted (Source: Annual Report of Statistics on Prosecution). |