| Previous Next Index Image Index Year Selection | |

|

|

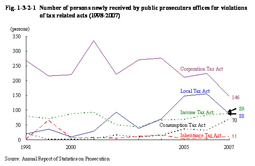

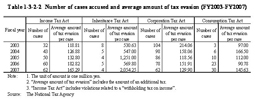

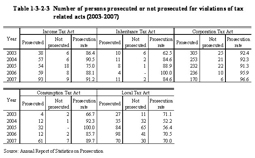

1 Tax evasion Fig. 1-3-2-1 shows the trends (over the last 10 years) in the number of persons newly received by public prosecutors offices for violations of Income Tax Act (Act No. 33 of 1965), Inheritance Tax Act (Act No. 73 of 1950), Corporation Tax Act (Act No. 34 of 1965), Consumption Tax Act (Act No. 108 of 1988), and Local Tax Act (Act No. 226 of 1950). In 2007, violations of the Corporation Tax Act (down by 79 cases (35.1%) from the previous year) and Local Tax Act (down by 67 cases (43.2%) (id.)) decreased while violations of the Consumption Tax Act (up by 38 cases (118.8%) (id.)) increased and violations of the Income Tax Act and Inheritance Tax Act continued to increase from the previous year. Fig. 1-3-2-1 Number of persons newly received by public prosecutors offices for violations of tax related acts (1998–2007) Table 1-3-2-2 shows the number of cases accused and the average amount of tax evasion accusations filed from the National Tax Agency to public prosecutors over the last five years.20 cases of tax evasion with the amount 300 million yen or more and among them seven cases 500 million yen or more were found in FY2007 (Source: The National Tax Agency). Table 1-3-2-2 Number of cases accused and average amount of tax evasion (FY2003–FY2007) (2) Disposition by public prosecutors officesTable 1-3-2-3 shows the number of persons prosecuted or not prosecuted by public prosecutors over the last five years for violations of respective tax acts. In 2007, summary trial procedures were taken for one out of 93 persons prosecuted for violations of the Income Tax Act and 17 out of 70 persons prosecuted for violations of the Local Tax Act, and all other prosecuted persons were indicted (Source: Annual Report of Statistics on Prosecution). Table 1-3-2-3 Number of persons prosecuted or not prosecuted for violations of tax related acts (2003–2007) (3) Persons disposed in the court of first instance in 2007Of the 65 persons finally disposed in court of first instance for Income Tax Act violations, 61 were sentenced to imprisonment with work for a limited term and four to fine. Seven persons were finally disposed in court of first instance for Inheritance Tax Act violations and all were sentenced to imprisonment with work for a limited term. Of 182 persons who were finally disposed for Corporation Tax Act violations, 82 were sentenced to imprisonment with work for a limited term, 93 to fine, and seven dismissed. Of 23 persons finally disposed for Consumption Tax Act violations, 14 were sentenced to imprisonment with work for a limited term and nine to fine. Of 29 persons finally disposed for Local Tax Act violations, 23 were sentenced to imprisonment with work for a limited term and six to fine (Source: Annual Report of Judicial Statistics and the General Secretariat of the Supreme Court; in regard to sentencing status of financial and economic offenses in court of first instance from 2005 to 2007, see Appendix 1-6). |