| Previous Next Index Image Index Year Selection | |

|

|

1 Tax evasion

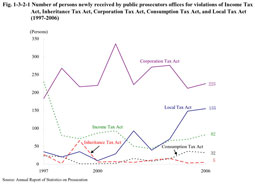

(1) Persons received by public prosecutors offices

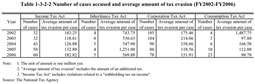

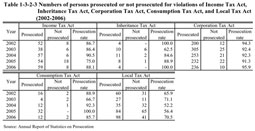

The trends (over the last 10 years) in the number of persons newly received by public prosecutors offices for violations of Income Tax Act (Act No. 33 of 1965), Inheritance Tax Act (Act No. 73 of 1950), Corporation Tax Act (Act No. 34 of 1965), Consumption Tax Act (Act No. 108 of 1988), and Local Tax Act (Act No. 226 of 1950), are as shown in Fig. 1-3-2-1. In 2006, violations of the Corporation Tax Act and Inheritance Tax Act, which had decreased in the previous year turned to a rise again, and violations of the Income Tax Act and Local Tax Act continued to increase from the previous year. Fig. 1-3-2-1 Number of persons newly received by public prosecutors offices for violations of Income Tax Act, Inheritance Tax Act, Corporation Tax Act, Consumption Tax Act, and Local Tax Act (1997-2006) Table 1-3-2-2 shows the number of cases accused and the average amount of tax evasion accusations filed from the National Tax Agency to public prosecutors over the last five years.17 cases of tax evasion with the amount 300 million yen or more and eight cases 500 million yen or more were found in FY2006 (Source: The National Tax Agency). Table 1-3-2-2 Number of cases accused and average amount of tax evasion (FY2002-FY2006) (2) Disposition by public prosecutorsTable 1-3-2-3 shows the number of persons prosecuted or not prosecuted by public prosecutors over the last five years for violations of the Income Tax Act, Inheritance Tax Act, Corporation Tax Act, Consumption Tax Act, and Local Tax Act. In 2006, summary trial procedures were taken for 26 out of 98 persons prosecuted for violations of the Local Tax Act, and all other prosecuted persons were indicted (Source: Annual Report of Statistics on Prosecution). Table 1-3-2-3 Numbers of persons prosecuted or not prosecuted for violations of Income Tax Act, Inheritance Tax Act, Corporation Tax Act, Consumption Tax Act, and Local Tax Act (2002-2006) (3) Persons disposed in the court of first instance in 2006Of the 38 persons finally disposed in court of first instance for Income Tax Act violations, 34 were sentenced to imprisonment with work for a definite term, 3 to fine, and 1 acquitted. 4 persons were finally disposed in court of first instance for Inheritance Tax Act violations and all were sentenced to imprisonment with work for a definite term. Of 187 persons who were finally disposed for Corporation Tax Act violations, 91 were sentenced to imprisonment with work for a definite term, 84 to fine, 1 acquitted, and 11 dismissed. Of 11 persons finally disposed for Consumption Tax Act violations, 6 were sentenced to imprisonment with work for a definite term, and 5 to fine. Of 37 persons finally disposed for Local Tax Act violations, 31 were sentenced to imprisonment with work for a definite term, 5 to fine, and 1 dismissed (Source: Annual Report of Judicial Statistics and the General Secretariat of the Supreme Court; in regard to sentencing status of financial and economic offenses in court of first instance from 2004 to 2006, see Appendix 1-6). |