| Previous Next Index Image Index Year Selection | |

|

|

4 Fraud, etc.

The number of cases reported for fraud leveled off or was decreasing until 2001, but increased significantly since 2002, reaching a record high since 1960 in the year 2005. However, in 2006, it decreased from the previous year (down by 10,964 cases (12.8%) compared to the previous year).

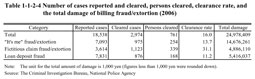

On the other hand, clearance rates continued decreasing from 1997 to 2004, but showed a slight recovery for the second consecutive year in 2006 (up by 6.0 points from the previous year). Recently, billing fraud cases are increasing rapidly, being one of the major factors raising the number of cases reported for fraud. Billing fraud /extortion collectively refers to the following three types; “It's me” fraud/extortion (a fraud or extortion case in which a perpetrator calls up a victim pretending to be a family member of the victim saying “It's me,” or a lawyer or a policeman, and asks for money for compensation to be placed immediately in a designated bank account to settle a fictitious trouble such as traffic accident), fictitious claim fraud/extortion (a fraud or extortion case in which a perpetrator makes a victim believe he/she has debt and pay a fictitious charge into a designated bank account by mail or the Internet), and loan deposit fraud (a fraud case in which a perpetrator pretends to lend money to a victim and makes him/her pay a deposit into a designated bank account). Table 1-1-2-4 shows the number of cases reported for billing fraud/extortion by type, the amount of damage, the number of cleared cases, the number of persons cleared, and the clearance rate. By modus operandi, the number of reported cases among “It's me” fraud was the highest for claims for compensation related to the embezzlement of money etc. at companies with 2,885 cases, followed by repayments for loan from personal financing companies (1,845 cases). Among fictitious claim fraud/extortion, claims for fictitious fees for websites were the most common with 1,787, followed by payments of fictitious debts to money lenders or debt collections with 648. The number of reported cases and persons cleared decreased by 3,074 cases (14.2%) and by 58 persons (7.1%) from the previous year respectively, while the number of cleared cases increased by 435 cases (17.1%) from the previous year. This is due to activities urging public awareness to prevent damage, as well as, various methods of security crackdowns in the illegal distribution of bank deposit accounts and cellular phones used in billing fraud and extortion cases pushed forward by relevant institutions. However, the number of cases reported for billing fraud/extortion accounted for about 22.3% of the total fraud/extortion cases in 2006, where such clearance rate was 16.0% and at a lower average in comparison to other fraud/extortion cases (42.0%) and non-traffic penal code offenses excluding theft (43.5%). Preventing the occurrence of billing fraud/extortion and their clearance remain to be important challenges. Table 1-1-2-4 Number of cases reported and cleared, persons cleared, clearance rate, and the total damage of billing fraud/extortion (2006) |