2 Economic offenses

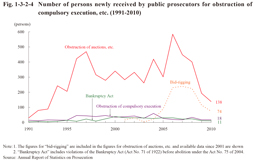

Fig. 1-3-2-4 shows the number of persons newly received by public prosecutors for obstruction of compulsory execution, obstruction of auctions, etc. (obstruction of auctions and bid-rigging), and violations of the Bankruptcy Act (Act No. 75 of 2004; Act No. 71 of 1922 before its abolition under the said Act in December 2004) over the last 20 years. The number of persons received for obstruction of auctions, etc. sharply increased from 1994 through to 1997, and then remained at a high level. However, it significantly decreased from 2009, and was 138 in 2010 (down 28.5% from the previous year).

Fig. 1-3-2-4 Number of persons newly received by public prosecutors for obstruction of compulsory execution, etc. (1991-2010)

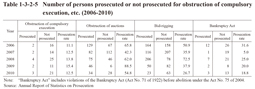

Table 1-3-2-5 shows the number of persons prosecuted or not prosecuted for obstruction of compulsory execution, obstruction of auctions, bid-rigging, and Bankruptcy Act violations over the last five years.

Examining the details of prosecutions in 2010 revealed that one person prosecuted for obstruction of compulsory execution, seven for obstruction of auctions, five for bid-rigging, and one for Bankruptcy Act violations were put on the summary trial procedure and all the others indicted (Source: Annual Report of Statistics on Prosecution).

The partial revision of the Penal Code on June 17, 2011 (by Act No. 74 of 2011) expanded the acts subject to penalty and raised the upper limit of the statutory penalty for obstruction of compulsory execution, etc. (enforced on July 14, 2011).

Table 1-3-2-5 Number of persons prosecuted or not prosecuted for obstruction of compulsory execution, etc. (2006-2010)

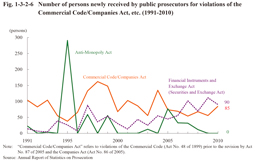

Fig. 1-3-2-6 shows the number of persons newly received by public prosecutors for violations of the Commercial Code (Act No. 48 of 1899 prior to revision by Act No. 87 of 2005)/Companies Act (Act No.86 of 2005; enforced on May 1, 2006), the Anti-Monopoly Act, and the Financial Instruments and Exchange Act (Act No. 25 of 1948; the title of the act was “Securities and Exchange Act” prior to September 30, 2007) over the last 20 years.

Fig. 1-3-2-6 Number of persons newly received by public prosecutors for violations of the Commercial Code/Companies Act, etc. (1991-2010)

In FY 2010 the Securities and Exchange Surveillance Commission filed formal accusations regarding Financial Instruments and Exchange Act violations against 15 persons (including juridical persons) in eight cases. By type of violation, five of them in four cases were accused for “insider trading,” four persons in one case for “submission of false statement for securities registration,” two persons in one case for “flotation without registration,” three persons in one case for “use of fraudulent means,” and one person in one case for “market manipulation” (Source: The Securities and Exchange Surveillance Commission). The Japan Fair Trade Commission filed no accusations of Anti-Monopoly Act violations (Source: The Japan Fair Trade Commission).

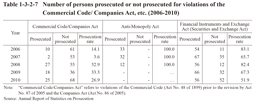

Table 1-3-2-7 shows the number of persons prosecuted or not prosecuted for violations of the Commercial Code/Companies Act, the Anti-Monopoly Act, and the Financial Instruments and Exchange Act (Securities and Exchange Act) over the last five years.

Examining the details of prosecutions in 2010 revealed that two persons prosecuted for Companies Act violations and seven persons prosecuted for Financial Instruments and Exchange Act violations were put on summary trial procedures and all the others indicted (Source: Annual Report of Statistics on Prosecution).

Table 1-3-2-7 Number of persons prosecuted or not prosecuted for violations of the Commercial Code/ Companies Act, etc. (2006-2010)

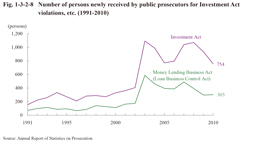

Fig. 1-3-2-8 shows the number of persons newly received by public prosecutors for violations of the Investment Act and the Money Lending Business Act (Act No.32 of 1983; the title of the act was “Act on Regulation, etc. of Loan Business” (hereinafter referred to as the “Loan Business Control Act”) prior to December 19, 2007) over the last 20 years. The number of persons received for violations of either of these acts sharply increased in 2003 and then remained at a high level. In 2010 the number of persons received for Investment Act violations was 754 (down 19.3% from the previous year) and that for Money Lending Business Act violations 303 (up 1.7% (id.)).

Fig. 1-3-2-8 Number of persons newly received by public prosecutors for Investment Act violations, etc. (1991-2010)

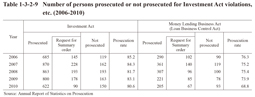

Table 1-3-2-9 shows the number of persons prosecuted or not prosecuted for violations of these acts over the last five years.

Table 1-3-2-9 Number of persons prosecuted or not prosecuted for Investment Act violations, etc. (2006-2010)

The Money Lending Business Act and Investment Act were amended by Act No. 115 of 2006 to counteract black-market financing. The upper limit of the statutory penalty for non-registered business activities was raised from imprisonment with work for 5 years to that of 10 years (enforced on January 20, 2007) and a new penal provision of imprisonment with work for 10 years as the upper limit of the statutory penalty was set for loan businesses imposing a higher interest rate than 109.5% per year (enforced on the same day). In addition, the amendment lowered the interest rate to which the penal provision for a high-interest loan business is applied (the upper limit of the statutory penalty is imprisonment with work for five years) from more than 29.2% per year to more than 20% per year (enforced on June 18, 2010).