3 Other Penal Code offenses

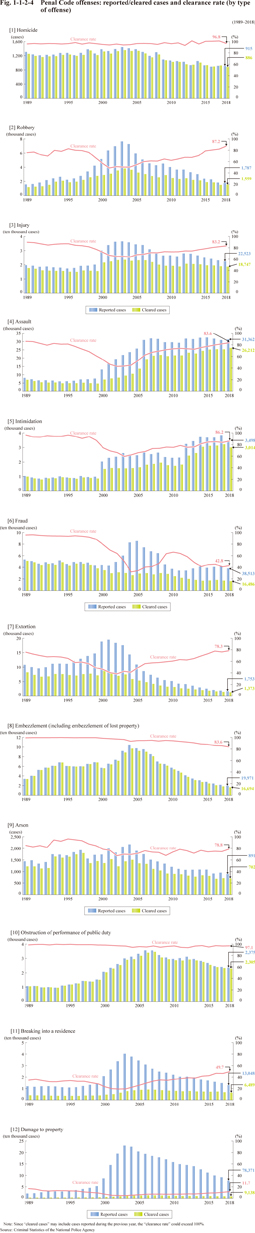

Fig. 1-1-2-4 shows the trend in the number of reported/cleared cases and the clearance rate for major Penal Code offenses.

Fig. 1-1-2-4 Penal Code offenses: reported/cleared cases and clearance rate (by type of offense)

Fig. 1-1-2-5 shows the trend in reported/cleared cases of so-called “special fraud”, and the amounts of damage caused. Special fraud is a generic term that refers to certain types of fraud or extortion offenses in which offenders use telephones or other devices to avoid confronting victims in person when defrauding/intimidating the victims into making money transfers or other means to profit the offenders. Among various schemes used in special fraud, those counted as “money-transfer fraud” include so-called “It’s me” fraud (offenders pretend to be the son or someone close to victims in need of urgent monetary assistance), fictitious billing fraud, loan deposit fraud (offenders fraudulently tell victims that an advance deposit is required to obtain a loan) or fictitious refund fraud (offenders pretend to be a public official who will assist victims to receive a tax refund or other type of repayment) (in 2004 and 2005, “It’s me” fraud, fictitious billing fraud and loan deposit fraud). Schemes of “other special fraud” may include, inter alia, sales of fraudulent financial instruments, provision of (baseless) information such as how to win in gambling or fraudulent date-matching.

Fig. 1-1-2-5 Special fraud: reported/cleared cases and amount of damage