| Previous Next Index Image Index Year Selection | |

|

|

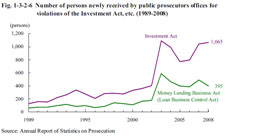

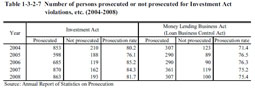

3 Financial offenses Fig. 1-3-2-6 shows the number of persons newly received by public prosecutors offices for violations of the Investment Act and the Money Lending Business Act (Act No.32 of 1983; the title of the act was “Loan Business Control Act” prior to December 19, 2007) over the last 20 years.Fig. 1-3-2-6 Number of persons newly received by public prosecutors offices for violations of the Investment Act, etc. (1989–2008) The number of persons received for violations of both these acts sharply increased in 2003 and then remained at a high level. In 2008 the number of persons received for Investment Act violations was 1,065 (up 2.5% from the previous year) and that for Money Lending Business Act violations was 395 (down 19.2% (id.)).Table 1-3-2-7 shows the number of persons prosecuted or not prosecuted for violations of these acts over the last five years. Examining the details of prosecution in 2008 revealed that 670 persons were indicted and 193 persons were put on summary trial procedures for Investment Act violations, while 211 persons were indicted and 96 were put on summary trial procedures for Money Lending Business Act violations (Source: Annual Report of Statistics on Prosecution). Table 1-3-2-7 Number of persons prosecuted or not prosecuted for Investment Act violations, etc. (2004–2008) The Money Lending Business Act (Loan Business Control Act) and Investment Act were amended by Act No. 115 of 2006. A new penal provision of imprisonment with work for 10 years as the upper limit of the statutory penalty was set up against loan businesses that impose remarkably high interest-rates of more than 109.5% per year. The upper limit of the statutory penalty against non-registered business activities was raised from imprisonment with work for 5 years to that for 10 years (enforced on January 20, 2007). In addition, the amendment will lower the interest rate to which the penal provision against high-interest loan businesses applies (the upper limit of the statutory penalty is imprisonment with work for five years) from more than 29.2% per year to more than 20% per year (to be enforced on a day specified by Cabinet Order within a period not exceeding two years and six months of the date of its enforcement on December 19, 2007). |