3 Financial offenses

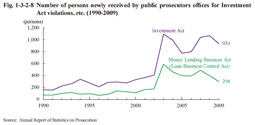

Fig. 1-3-2-8 shows the number of persons newly received by public prosecutors offices for violations of the Investment Act and the Money Lending Business Act (Act No.32 of 1983; the title of the act was “Loan Business Control Act” prior to December 19, 2007) over the last 20 years. The number of persons received for violations of either of these acts sharply increased in 2003 and then remained at a high level. In 2009 the number of persons received for Investment Act violations was 934 (down 12.6% from the previous year) and that for Money Lending Business Act violations 298 (down 24.6% (id.)).

Fig. 1-3-2-8 Number of persons newly received by public prosecutors offices for Investment Act violations, etc. (1990-2009)

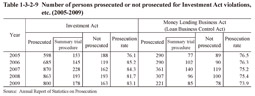

Table 1-3-2-9 shows the number of persons prosecuted or not prosecuted for violations of these acts over the last five years.

Table 1-3-2-9 Number of persons prosecuted or not prosecuted for Investment Act violations, etc. (2005-2009)

The Money Lending Business Act (Loan Business Control Act) and Investment Act were amended by Act No. 115 of 2006 to counteract black-market financing. The upper limit of the statutory penalty against non-registered business activities was raised from imprisonment with work for 5 years to that of 10 years (enforced on January 20, 2007) and a new penal provision of imprisonment with work for 10 years as the upper limit of the statutory penalty was set up against loan businesses imposing a higher interest-rate than 109.5% per year (enforced the same day). In addition, the amendment lowered the interest rate to which the penal provision against high-interest loan businesses applies (the upper limit of the statutory penalty is imprisonment with work for five years) from more than 29.2% per year to more than 20% per year (enforced on June 18, 2010).