| Previous Next Index Image Index Year Selection | |

|

|

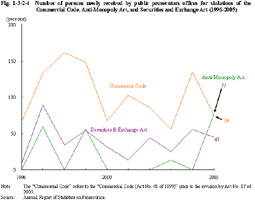

2 Economic offenses Fig. 1-3-2-4 shows the number of persons newly received by public prosecutors offices for violations of the Commercial Code (Act No. 48 of 1899 prior to the revision by Act No. 87 of 2005, hereinafter the same), Anti-Monopoly Act, and Securities and Exchange Act (Act No. 25 of 1948) over the last 10 years.

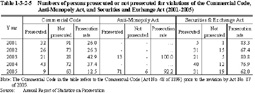

Fig. 1-3-2-4 Number of persons newly received by public prosecutors offices for violations of the Commercial Code, Anti-Monopoly Act, and Securities and Exchange Act (1996-2005) In FY2005, the Securities and Exchange Surveillance Commission filed formal complaints for 11 cases (28 persons) with public prosecutors for Securities and Exchange Act violations. More specifically, four cases (4 persons) were charged with insider trading, two cases (two persons) with market manipulation, one case (six persons) with spreading rumors on stock markets and deceptive means, and four cases (16 persons) with submission of false financial statements, etc. (Source: The Securities and Exchange Surveillance Commission).In FY2005, the Fair Trade Commission filed an accusation for two cases (47 persons including juridical persons) of Anti-Monopoly Act violation (Source: The Fair Trade Commission). Table 1-3-2-5 shows the number of persons prosecuted or not prosecuted by public prosecutors over the last five years for violations of the Commercial Code, Anti-Monopoly Act, and Securities and Exchange Act. Table 1-3-2-5 Numbers of persons prosecuted or not prosecuted for violations of the Commercial Code, Anti-Monopoly Act, and Securities and Exchange Act (2001-2005) In 2005, summary trial procedures were taken for one out of nine persons prosecuted for violations of the Commercial Code, but all other prosecuted persons were indicted (Source: Annual Report of Statistics on Prosecution). |