| Previous Next Index Image Index Year Selection | |

|

|

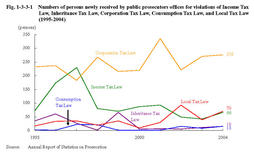

1 Tax evasion (1) Persons received by public prosecutors offices Fig.1-3-3-1 shows the number of persons newly received by public prosecutors offices for violations of Income Tax Law(Law No.33of1965),Inheritance Tax Law(Law No.73of1950),Corporation Tax Law(Law No.34of1965),Consumption Tax Law(Law No.108of1988),and Local Tax Law(Law No.226of1950),over the last10years.

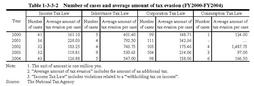

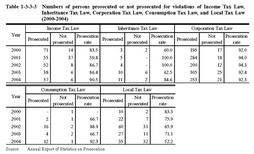

Fig.1-3-3-1 Numbers of persons newly received by public prosecutors offices for violations of Income Tax Law,Inheritance Tax Law,Corporation Tax Law,Consumption Tax Law,and Local Tax Law(1995-2004) Table1-3-3-2 shows the number of cases and the average amount of tax evasion charged from the National Tax Agency to public prosecutors over the last five years.Seventeen cases of tax evasion with the amount over300million yen and six cases over500million yen were found in FY2004(Source:The National Tax Agency).Table1-3-3-2 Number of cases and average amount of tax evasion(FY2000-FY2004) (2) Disposition by public prosecutors Table1-3-3-3 shows the number of persons prosecuted or not prosecuted by public prosecutors over the last five years for violations of the Income Tax Law,Inheritance Tax Law,Corporation Tax Law,Consumption Tax Law,and Local Tax Law.

In2004,all prosecuted persons were indicted(Source:Annual Report of Statistics on Prosecution). Table1-3-3-3 Numbers of persons prosecuted or not prosecuted for violations of Income Tax Law,Inheritance Tax Law,Corporation Tax Law,Consumption Tax Law,and Local Tax Law(2000-2004) (3) Persons disposed in court of first instance in 2004 A total of39persons were sentenced to imprisonment with labor for a limited term for Income Tax Law violations.Nine were sentenced to imprisonment with labor for a limited term for Inheritance Tax Law violations.Of the222prosecuted for Corporation Tax Law violations,101were sentenced to imprisonment with labor for a limited term,109to fine,and12dismissed.Of the ten prosecuted for Consumption Tax Law violations,seven were sentenced to imprisonment with labor for a limited term and three to fine.Of the26prosecuted for Local Tax Law violations,20were sentenced to imprisonment with labor for a limited term,five to fine,and one dismissed(Source:Annual Report of Judicial Statistics,and The General Secretariat of the Supreme Court;See Appendix1-6 for the terms of imprisonment with labor sentenced for financial and economic offenses in the court of first instance during the period from2002to2004).

|