| Previous Next Index Image Index Year Selection | |

|

|

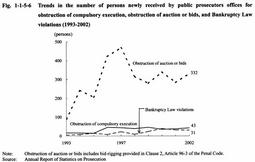

3 Other economic offenses Fig. 1-1-5-6 shows the trends in the numbers of persons newly received by public prosecutors offices over the last 10 years for obstruction of compulsory execution, obstruction of auction or bids (including bid-rigging provided in Clause 2, Article 96-3 of the Penal Code; hereinafter the same in this section), and Bankruptcy Law violations.

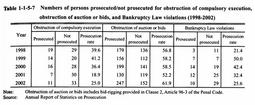

Fig. 1-1-5-6 Trends in the number of persons newly received by public prosecutors offices for obstruction of compulsory execution, obstruction of auction or bids, and Bankruptcy Law violations (1993-2002) Table 1-1-5-7 Numbers of persons prosecuted/ not prosecuted for obstruction of compulsory execution, obstruction of auction or bids and Bankruptcy Law violations (1998-2002) In 2002 among those prosecuted, formal trials were requested for 5 persons and summary orders for 6 Persons for obstruction of compulsory execution. For the obstruction of auction or bids, formal trials were requested for 146 persons and summary orders for 101 persons. For Bankruptcy law violations, formal trials were requested for all 10 persons.Table 1-1-5-7 Numbers of persons prosecuted/not prosecuted for obstruction of compulsory execution, obstruction of auction or bids, and Bankruptcy Law violations (1998-2002) These bankruptcy-related offenses usually occur over the collection of bad debts. In particular, collection of bad debts owned by failing financial institutions has become one of the biggest problems in the Japanese economy. Under the Law Concerning Emergency Measures for the Revitalization of the Financial System (Law No. 132 of 1998), the Resolution and Collection Corporation (hereinafter referred to as the "RCC") collects and resolves bad debts purchased from financial institutions, regardless of whether they are already failing or not. In order to rigorously pursue criminal responsibility for offenses related to collection of bad debts owned by failing financial institutions, directors of the RCC should take necessary actions for charging of such offenses under the Law. In FY 2002, the RCC brought charges in a total of 31 cases (64 persons), 11 cases (24 persons) of which were for the obstruction of auction by force or deception, 6 cases (13 persons) for obstruction of compulsory execution, 4 cases (13 persons) for breach of trust or aggravated breach of trust, 4 cases (7 persons) for fraud, 2 cases (2 persons) for intimidation, 1 case (2 persons) for Bankruptcy Law violation, 1 case (1 person) for forgery/uttering of private documents with seal, 1 case (1 person) for assault, and 1 case (1 Person) for Physical Violence Law violation (Source: Data by Deposit Insurance Corporation). |