| Previous Next Index Image Index Year Selection | |

|

|

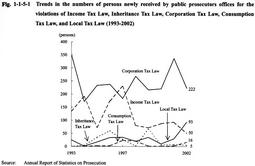

1 Tax evasion offenses (1) Persons received by public prosecutors offices Fig. 1-1-5-1 shows the trends in the number of persons newly received by public prosecutors offices for the violations of Income Tax Law, Inheritance Tax Law, Corporation Tax Law, Consumption Tax Law, and Local Tax Law, over the last 10 years. It is notable that the number for Corporation Tax Law violations has been the largest since 1998 and that the number for Local Tax Law violations increased in 2002.

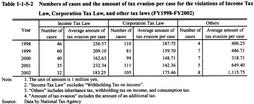

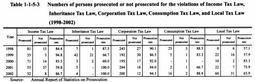

Fig. 1-1-5-1 Trends in the numbers of persons newly received by public prosecutors offices for the violations of Income Tax Law, Inheritance Tax Law, Corporation Tax Law, Consumption Tax Law, and Local Tax Law (1993-2002) Table 1-1-5-2 shows the trends in the number of cases and the amount of tax evasion per case charged from the National Tax Agency to the public prosecutors offices for the violations of Income Tax Law (excluding violations relating to withholding tax on income), Corporation Tax Law, and other tax laws (including violations relating to withholding tax on income), in each fiscal year over the last 5 years. There were 26 cases of tax evasion with the amount over ¥300 million and 13 cases with the amount over ¥500 million in FY 2002 (Source: Data by National Tax Agency).Table 1-1-5-2 Numbers of cases and the amount of tax evasion per case for the violations of Income Tax Law, Corporation Tax Law, and other tax laws (FY1998-FY2002) (2) Disposition by public prosecutors offices Table 1-1-5-3 shows the trends in the number of persons prosecuted or not prosecuted by Public prosecutors offices over the last 5 years for the violations of Income Tax Law Inheritance Tax Law Corporation Tax Law, Consumption Tax Law, and Local Tax Law.

Table 1-1-5-3 Numbers of persons prosecuted or not prosecuted for the violations of Income Tax Law, Inheritance Tax Law, Corporation Tax Law, Consumption Tax Law and Local Tax Law (1998-2002) (3) Disposition by courts According to the Annual Report of Judicial Statistics and data provided by the General Secretariat of the Supreme Court, the number of persons finally disposed by the courts in the ordinary first instance in 2002 (excluding those transferred, etc.) was 49 for Income Tax Law violations (45 were sentenced to imprisonment with labor for a limited term, 2 were to fine, and the prosecutions were dismissed for 2,), 205 for Corporation Tax Law violations (93 were sentenced to imprisonment with labor for a limited term, 106 were to fine, and the prosecutions were dismissed for 6,), 1 for Inheritance Tax Law violations (sentenced to imprisonment with labor for a limited term), and none for Consumption Tax Law violations (see Appendix 1-7 for the terms of imprisonment with labor sentenced in the ordinary first instance during the period from 1998 to 2002).

|